Selling to Different Buyer Types

Blair details each buyer type (Convenience, Relationship, Price, Value, and Poker Player), and demonstrates how your proposal should do the negotiating work for you regardless of which type of buyer you’re selling to.

Links

The Strategy and Tactics of Pricing, 3rd Edition by Thomas Nagle and Reed Holden

Pricing With Confidence by Reed Holden and Mark Burton

Negotiating With Backbone by Reed Holden

Transcript

David C. Baker: Blair, today, I'm interviewing you on selling to different buyer types. This one's got my mind churning. When you were putting some thoughts together for this, did you think about what a buyer type you are?

Blair Enns: People can be different buyer types and organizations can be different buyer types depending on what they're buying. I would say I tend towards being a value buyer on most stings where it's not so much the price that matters, it's the return. Even my wife and I were having a conversation yesterday on maybe buying a building and she said, "Oh, it's probably priced, big number," and I said, "The number doesn't matter. Let's look at the return." The number is only one-half of the equation. It only matters relative to the return on the income. I tend to value buyer and I think my wife maybe tends to price buyer. How about you?

David: I don't know. I feel very confused about what kind of a buyer I am, maybe because I feel like I show up in different ways. Before we get into the meat of this, that was one of the questions I wanted to ask is, you're running an agency, you're in charge of new business, you're in charge of growth, you're the principal, whatever, and you're trying to figure out what kind of a buyer is on the other side of the table. Is it about figuring out what kind of a buyer that person is? Or do organizations have a particular buyer mode or could they differ? I was confused about whether we're trying to analyze the buyer or the organization.

Blair: It's really the organization, and we'll get into this because even once you understand the buyer types and we'll describe them all, you'll be in a situation, a seller or a negotiation where you're convinced this person is a price buyer and they might be, but they are kind of put on the front lines as a negotiating tool when really the people making the decision behind the scenes are value buyers or relationship buyers.

We do have to pay attention to the person, but it's really about the organization. It's actually not that hard to discern price buyers in particular, and we're talking about this without defining the terms yet, but price and value buyers are pretty easily. You can understand them just from the labels. It's pretty easy to spot a price buyer, although we do tend to, when we're in a negotiation, once we understand buyer types, assume that a hard negotiator is a price buyer and that's not necessarily true.

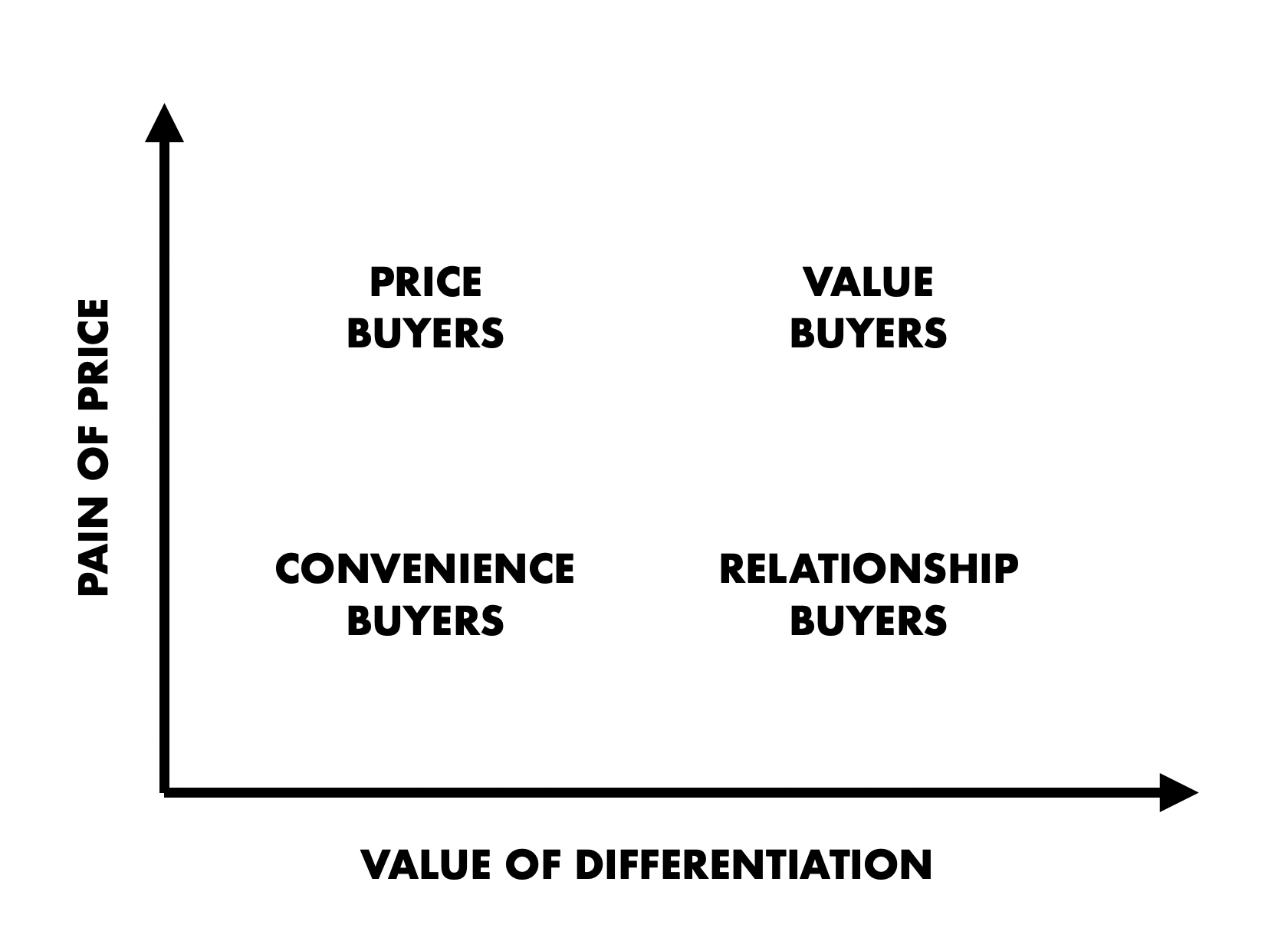

David: This is going to be really interesting. I've heard so much nonsense about this. You're going to take a little bit more of a scientific approach along two axes. Where does some of this science come from, and what are the two axes? As you're listening to this, this might be a great time to just pause, and at least look at the show notes, look at the four quadrants on this because you need to have that in mind, or you'll get lost in some of the detail, but where's the science come from? What are the two axes?

Blair: Everything I'm going to talk about here comes from the work of a couple of individuals. The first one is Tom Nagle, and the second one is Reed Holden. These are both academic professionals, so professional advisors, I think Tom Nagle's fully retired now. I'm not sure about Reed Holden. He's a little bit younger, but he's at that age where he might, I'm not sure if he's actively working, but his business Holden Advisors is still out there.

They co-authored a book in 1987 called The Strategy and Tactics of Pricing. It's a 35-year old book. I have the third edition. There might be a fifth edition now with even more co-authors, I don't remember. It's seen as the Bible of pricing, but most listeners, if they're interested in pricing, most listeners to this podcast would hear that and go out and buy that book and they would not be able to read it.

It's pretty dance, it's pretty academic, and there's a lot of stuff in there on pricing goods that's barely relevant to our world. It's a lot of heavy reading to discern some key principles. What Reed Holden did after he formed his own business, he wrote a couple of books that I've talked about before, and they're smaller more relevant to our audience. One is called Pricing With Confidence, and the second one is called Negotiating With Backbone. They're both pretty slim books, easy to read. They work really well together. This combination of pricing and negotiating.

I'm fond of saying that I come at pricing from a sales perspective, because when it comes to customized services, you cannot be a good pricer without also being a good salesperson, and so much pricing advice does give short shrift to the sales skills required and the communication skills required to be an effective price.

Reed Holden does a very good job via those two books of tying the subjects together. Everything I'll talk about here in buyer types originally came from Nagle and Holden. We'll talk about the four main buyer types and then Holden added a fifth buyer type in a subsequent books, the two books that I just mentioned. We'll talk about those and that's where everything I'm talking about comes from now. If you were to Google buyer types, if you do a search for buyer types, you get all kinds of different models.

All kinds and with all these different labels and there's not much, I only spent 20 minutes or so looking through these the other day. There's not much rigor to these models that I can see. What I like about Nagle and Holden's model is they have, as you said, plotted buyer types on these two axes and there is a little bit of scientific rigor to this and they've done both of them together and then individually, they've done some research on buyer types.

David: You said something just a minute ago and I want to extend it further. You said you can't be really good at pricing unless you're good at selling. I'd to extend it too, you can't be really good at selling unless you're pretty good at lead gen and you can't be really good at lead gen unless you're good at positioning. In other words, this stuff is all academic unless you have sufficient opportunity to be able to walk away from something. As we go through this would it be useful for people to think through their current client base and remember what those sales conversations were like when they landed those clients and try to put those specific clients that are on their roster into one of these four categories?

Blair: That's a great suggestion. As we're talking about the buyer types, if you have your client roster in front of you, even if it's just mental, just think about if you can identify what client is, what buyer type.

David: What are the two axes and what are the four types that are plotted on this?

Mlair: The two axis on the X-Axis, we have the perceived value of the product or in this case firm's difference. It's the value of differentiation. Different buyers will see value in how meaningfully different you are to them from firm to firm and some buyers just will not. They just don't see that what you offer is different from what it is that your competitors offer. It's important to be able to understand that, that's access number one on the X-Axis and on the Y-Axis is the pain of price.

Some clients are price sensitive and some clients are less price sensitive. We'll make a generalization of low and high on both of those. The perceived value of differentiation to that client and the pain of price or price sensitivity to that client. Those are the two axis.

David: The first of four is the convenience buyer. This is somebody with low pain, low value of differentiation. How would you describe this first category?

Blair: This doesn't come up a lot in the literature anymore, but I really like this idea of convenience buyer because in a fairly recent episode, I think I use this line. That's this old school sales trope of the client asks the salesperson, "What's your competitive advantage and they're referring to the product and the line that salespeople would share with each other. Basically the thought that they're thinking that they don't say out loud is that my competitive advantage is that I have you on the phone right now.

Now that's not always a competitive advantage, but there are clients who are in certain situations where speed to decision is more vital than taking the time to sort through who is the best firm. Somebody who's a convenience buyer is somebody who needs to hire a firm like yours now. Crisis communication is a great example or if something's change, you notice in the news that an organization has experienced some change, maybe a turnover or a change in legislation or something a competitor is doing.

That means that they need to act quickly. It's more important to them to hire somebody immediately and get going. They don't have the time to sort through all of the different options and therefore they don't see the value. They're willing to overpay a little bit. It's one way of thinking about it. Another way to put it is they're less price sensitive. They're willing to pay a premium to get somebody, anybody, right now.

David: Would this apply to somebody who gets a new job let's say, a CMO or a product manager, and they need to hit the ground running. They need to show some evidence of the fact that this was a good hire pretty soon and so they bring their agency, their creative firm in with them. It's almost like when a new head coach gets hired. They'll often bring assistance that they know is that part of a convenience play.

Blair: Yes. As you were beginning to describe the situation, I'm thinking No, because there's nothing about, so somebody comes in, they wants to make an impression they want a big win early, but the answer the way you fully framed it is yes. That's why they bring in their old firm. If you were with them at another place, it's because they already understand you.

They don't have time to shop around and look for somebody who's better than you. In that case, they're willing to pay a price premium. Now you do have this pricing history with them, and that might be a mitigating factor but if you said in that moment, "Listen, we can't be charging you what we charge at the old place." You would have more leeway in that moment to be able to charge more.

David: What's the role of say a more of an outbound-oriented marketing plan with a client like this?

Blair: We've talked about the ladder of lead generation before, where you have high status and low-status lead generation based activities and the low-status ones at the bottom are sales based is the high-status ones at the top are education based activities. Then you've got marketing in the middle. As experts, we try to climb that ladder over time, move our lead generation activities to those things that position us as the expert and drive inbound inquiries to us but the trade-off in that is immediacy. I'm always fond of saying there should be room for some time outbound in your lead generation plan and specifically around these convenience buyers.

Yes, maybe they'll come to you. Some of them will come to you through all of that high status thought leadership that you put out into the world but this idea of convenience buyer really makes a case for keeping eyes peeled, observing changes in marketplace legislation, personnel at key organizations, and then pouncing on those situations where somebody clearly needs to act now and therefore, they're going to be less price-sensitive, and they're going to be less inclined to do a full evaluation of the alternatives. Timing is everything. If timing is everything for that type of buyer, it really makes a strong case for seeding some timely outbound lead generation activities into your lead generation plan.

David: There's a firm in Chicago that sells based on passing certain boundaries or being activated by certain triggers. A leadership change, they say, I'm reading their website now, a product launch, a market entry, a capital investment, they're stuck or stalled merger acquisition. Here there's not just a normal, we really need to get this fixed in the next 15 months. It's something that's a little bit more immediate than that. That's part of this convenience play. That's the first, what's the second one?

Blair: Second buyer type is a relationship buyer. This one is in the bottom right-hand quadrant. They have low pain of price or low price sensitivity, just like the convenience buyer, but they really do value the differences that you bring. Internally, they have what you would call the technical skill. It's not always technical. Sometimes it's just the ability to appreciate good creative, but let's call all of that technical skill, subject matter expertise, where they have the ability to discern how good you are compared to the others that they might hire but the key attribute of relationship buyers is they have a strong what's known as brand preference.

It's like, oh, I really want to work with one firm. They see that firm as meaningfully different and then as you and I talked about in an earlier episode, they're buying a relationship with you. What that means is they really want you to go deep into their organization. Very often, it's their preference that they buy everything they possibly can from you. They want to have as few providers as possible so you think of the typical, the old school agency of record relationship that was typically not always, but it was typically a relationship by where if you were the agency of record, your organization's got to know each other very well.

You were, in some ways, maybe even quasi embedded, you had relationships going all the way up to the top of the organization with the client-side organization. In fact, with the relationship buyer, one of the hallmarks is senior management on the client side is typically involved in the decision to hire you and is typically involved in the relationship moving forward.

David: As you were describing that, I felt my heart fall because I pictured myself being in a competitive maybe pitch or not. Maybe it's not a formal pitch, but this client is, I don't know, they have a preference for this firm, and yet something about the process requires them to talk with several others. It's like, I don't want to be the one of three and if I'm not the preferred choice, I want to find out if they have a preference in here. Because the odds are pretty low that you're going to switch that in their mind, aren't they?

Blair: Yes. Another hallmark of relationship buyers is they don't want to switch. Switching costs are high because the relationship is so enmeshed like I've said before, the idea that, where the bodies are buried on the client-side organization, David, you and I have clients that we look at their client roster and they've worked with some organizations for 10 or 20 years where the average client-agency relationship might be three or four years, you get these anomalies.

David: They've actually outlasted, did three CMOs and they know it, they're proud of it.

Blair: Yes, Wieden's worked with Nike for 40 years, right?

David: Yes.

Blair: It's not that they hire Wieden to do everything, there are other marketing firms that work with Nikes but back in the early days, when the tools of marketing weren't so fragmented, I suspect that almost everything went to Wieden so that's a real relationship. There are people on the agency side of that relationship, and I'm not professing to have any real inside knowledge there just, it's fairly publicly understood. There have to be people on the agency side that just know so much about the client-side organization.

When you look at how the people in the agency side are promoted in their career progressions, they're almost always tied to that one client different roles with different clients, and it's a global client they get moved around globally and some of these people in the agency side become such a huge asset to the client that the idea of parting company with them is just even though there's almost certainly moments of frustration and I was in an agency side of one of these relationships where we drove each other crazy when I say we lots of people on both sides, but we were deeply enmeshed with the client. Everybody understood the value of that client being a relationship buyer and us being in that type of AOR relationship.

David: If I recall correctly, Nike is also the firm that is requiring many of their "vendors", which I guess that word is indicative of a problem to reverse bid on those relationships, but I'm guessing that widen is probably not subject to those same rules. You're not going to displace very often a relationship buyer.

David: We have convenience, we have relationship and the third is price. My first thought is price Okay. This must be all bad, but it's not all bad. What does it mean first?

Blair: It's not all bad and we'll get there in a few minutes. You have to decide if you want to do business with price buyers. As soon as you understand price buyers, and you understand how you can deal with them, it doesn't become all bad and it can actually be fun negotiating with them. Price buyer is somebody who wants the lowest price possible and they're willing to give up all of the extras so you think of in your firm, you have this idea of, this is how we do things around here. We have to charge what we charge because we things a certain way and you say that with pride and if you're going to deal with price buyers, and almost everybody has price buyers and their client roster, you have to let go of that idea.

I think that idea is really limiting, there are times when, if you are going to do business with price buyers, you really need to not give them the full meal deal. The cost sears level service that you're so proud of delivering to all your clients. You really need to unbundle everything and find a way to sell them the core service offering at a low price and the first reaction to that is often, well, look, what can we strip out?

If you spend five minutes thinking about it, there's a million things that you can strip out, your level of account service, your level of oversight, reporting terms, all kinds of things that you can strip out. Price buyers are highly specked, they're self-diagnosed and self-prescribed whether right or not is another issue. They know exactly what they want to buy. They spec it out in detail and they send the RFP to numerous providers and numerous to me means more than three or four. You get five-plus firms detailed specs, and they just want to see your price.

David: They're not going to spend time diving deeply into relationship building with each of these. Six firms that have received it so to them, it's still not all that inefficient. Isn't this also the client that's going to resist your normal $40,000 or $140,000 roadmap or diagnostic?

Blair: Yes. They don't want to pay for the strategy. If there's a strategy component to what you do, you're typically bundling it up and not breaking it out, not putting a price on it, and not making a line item on the proposal per se. They also, [unintelligible 00:20:26] switching costs. You think of a relationship builder, deeply embedded with high switching costs. Price buyer doesn't want to go deep into a relationship.

They don't want to subscribe to your platform, or if you have a [unintelligible 00:20:42] product or something that requires some ongoing support because they want to be able to switch at a moment's notice. I think most people listening to this have encountered clients who've said, no, it's our policy, we review the relationship every year or two years, whatever it is. That's typically a sign of a price buyer. They don't want to be locked in. They put you on notice that you've got to keep your pencil sharp. It's often driven by procurement. There's room to have, occasionally, some clients that fall under this category, especially if you have the capacity to sell, I suppose.

David: If you think of a plant-

Blair: I think back to Eli, is it Goldratt? His name is escaping me, who wrote The Goal? It's a business novel. It's taught in all MBA schools about the theory of constraints. Basically, there's a guy running a plant trying to get productivity up and every time he makes a change somewhere else, he creates a bottleneck or a pinch point in another place. One of the lessons in that book is if you're running at say like 80% capacity and you have this excess capacity, so we're talking about a manufacturing plant here, but the principle still applies in a creative firm.

You have this excess capacity and a price buyer comes along and says, "I want to buy something very clear, very specific without all the add-ons but I want to give you a low price, a price that you would never give me unless you were in this situation where you're thinking, well, I've got all these people. I have some extra capacity just sitting there unused." I think that's how you think about price buyers, is you sell them the excess capacity at a time when you have excess capacity and if you don't have excess capacity, you tell them to go away.

David: Just recognizing you got to be honest with yourself and say, "Listen, when your capacity is a little bit constrained, you're not going to turn this same buyer into a different buyer."

Blair: That's a key point. That's why we're talking about this, you think you're going to convert this price buyer. You're going to put these other higher value, more expensive options in front of them, and like a lot of clients will, they will choose to give up the low-priced option because there's a whole bunch of stuff. The value drivers coming from you that they're giving up like maybe access to senior decision-makers and price buyers just are not. The airline equivalent I like to say is a price buyer who buys the cheapest price on an airline. They'll give up oxygen. They'll hold their breath on the flight to get the lowest price.

David: Some of these carriers are going to start charging you to breathe.

Blair: [laughs]

David: Oh, that's extra, I had no idea. You wanted to do that on this flight.

Blair: Trial and error.

[laughter]

David: We have convenience buyers. We've got relationship buyers. We've got price buyers and the last one is value buyers. I like the way this one sounds, don't disappoint me here.

Blair: It's exactly what it sounds. It's not so much the price they pay. It's the value they get, doesn't mean that they don't negotiate. We talk about switching costs and the likelihood of switching that doesn't show up on the axis but what's interesting about value buyers is they will switch, but they don't switch for price.

They'll switch because they're so focused on improving performance that if somebody comes along and that somebody is you and they're in a relationship and you can demonstrate that you can create more value even at a higher price, you can create more value than the firm they're working with. They will absolutely consider switching, so they're not as deeply embedded and loyal as a relationship builder but as long as you keep providing value, you can charge more. Just like I said at the top of this recording, the cost of a builder, it's only half of the equation. You can't take the cost in isolation from the revenue so that's how a value buyer thinks.

David: I haven't talked about this recently, but I used to talk a lot about this. I don't know why I quit, but it'd be good when you're going into a selling situation to try to figure out as soon as possible, what a buyer it is. Then one mental trick I like to play is to just anticipate, just take an educated guess about how long this client relationship will last and it's fun. I actually think you ought to do that in other areas of your life too, your friends, your employees, your mate.

Blair: I've heard you say it out loud.

David: Exactly, like, "Oh, let's get married. I picture this lasting about seven years, but it's going to be a great seven years. Let's do it."

Blair: [laughs]

David: Now this is somebody who's been married very long time so don't misunderstand me and Julie, if you're listening to this, I'm sorry for that.

Blair: [laughs] The good thing is our wives don't listen to this podcast.

David: Yes, thank God.

Blair: One of the things I love about value buyers is they're open typical to value based pricing.

David: Right

Blair2: It's not like, you think of where they're plotted on the graph. They're in the top right. Hand corner so they value the differences that you bring, how meaningfully different you might be from your competitors. They're also price-sensitive. There's this pain of price, but it's not the same way a price buyer is price-sensitive. A price buyer is the person who just looks at the price, the one half of the equation.

David: The cost of the building.

Blair: The cost of the building, right. The other one is price sensitive on more of an ROI basis so it's similar but different.

David: Then there's a fifth one that's thrown in. Was this because we couldn't throw everybody into one of these four categories or what's this fifth one that pops up?

Blair: I was reviewing the literature over the last couple of days. I was complaining to you that I had to do research to do this episode and then this morning when I'm saying to my wife, "I got to go record this thing with David." She said, "That's what you've been working on the last few days". Then she said, "You wrote about us in pricing creativity". I'm like, ah, "I thought I might have, I should really read my own books."

[laughter]

This is Reed Holden's contribution to the work that he and Nagle did originally this idea of a fifth buyer type. I noticed he doesn't talk about convenience buyers anymore. I'd love to have a conversation with him and ask why, but the poker player. A poker player is a value buyer or a relationship buyer. Somebody out on the right-hand side of the spectrum where they really value the differences from firm to firm, they don't see you as a commodity, they see that you're different, your ability to create value is different. They're one of the more desirable buyer types. They present a price buyer and it's simply because they love the game of pricing and negotiating. They love to play the game.

David: I was working with somebody recently and I thought they'd already bought this thing. I hadn't really paid or anything, but I thought this was a done deal and then right before the end, I got an email and it says, "Oh, we're ready to move ahead if you can discount it to this amount." I was like, I [unintelligible 00:27:34] going to laugh and say, sorry, I guess you don't understand me, that ain't happening.

They signed up anyway and they were a decent client. Then they went to work with a friend of mine and this friend told me that they had done exactly the same thing. It was almost exactly the same email. We're ready to buy as long as you can drop it by 20%. Of course, the friend had the same reaction I did, but that's what this is,right?

Blair: That's exactly what this is and people listening to this are thinking, oh, yes, I've had that happen to some of you many times where it's like, you're dealing with the decision maker and then you think you have a deal in principle and you go to the contract stage and then out to the blue comes procurement. They start hitting you with these lines, some of which are at right lies. They play chicken, they stall, they do all the usual procurement games, but you think you're dealing with the value buyer because you've had conversations about the value to be created.

Maybe it's even value based pricing, whatever it is, without even maybe understanding the buyer type you just to realize, oh, this is a good client. They appreciate and value what we do. We're going to be able to have an impact on their business. We're going to be able to make some money here. Everything feels like it's just progressing through close and then somebody comes out to the word work. It's often procurement, but not always who starts to play hardball. I've dealt with this situation. I've heard from agency folks, dozens, maybe hundreds of times. Now that have experienced this and they're so traumatized by the experience.

David: They need to understand that this is almost always, if the sale has progressed in a way that I've just described it, you're working with the end user effectively, the person who will be your client and you're progressing through the sale and it's respectful and you're talking about value and they don't seem to be too price sensitive and everything, it feels like you've been hired verbally subject to working out some details and then procurement comes in at the last minute.

Almost everything that they tell you will be a lie. Like Holden says, "There's the three ways to play poker". There are three strategies, A, hold the winning hand, B, bluff, C, fold. If you don't have a winning hand, it just fold, walk away, but the bluff-- Your example is you just simply held the winning hand. You recognized your value. You knew that others in the organization recognize your value and then this game shows up at the last minute. That's a poker player.

David: Yes. It's discouraging because it has felt so good all along, but the reason it works is because you have invested so much in the sale, not unrealistically. The investment you put in the sale has been appropriate but it just feels like somebody's taken the rug out from under you and it really is difficult to walk away from that but that's where you really have to, or do something.

Blair: You have these emotional sunk costs. Maybe not hard costs, maybe not even a whole bunch of time, but it feels like, oh, we're going to work together. This is a great client. We're going to do great work. We'll make some money here. Then out of the blue somebody [unintelligible 00:30:41] you. I had that happen to me, quite a famous owner of a really highly regarded firm. I was hired to do some consulting. They agreed to my initial price. I think I was dealing with one of the other partners and then the founder and the major partner emailed after basically said, "No, you need to get the price down considerably." Forget how I handle it but I basically politely said, "No, that's fine. We don't need to work together. If you think it's too expensive." His reply back was, "No, we'll go ahead." He said, "I'm not questioning the value." He said, "I just make it a point to try to negotiate everything." I thought, "Oh, I really respected that."

David: All right. We need to understand the four buyer types because we got to figure out what it is they want and how to sell to them. If we take this and apply it to a different industry, it might be different, but in the industry you and I serve, how would you rank these different buyer types? What would you put at the top?

Blair: I would put the relationship builder at the top for reasons we've talked about before and already here. This idea of deeply embedded, we become part of the team. We get so enmeshed. Again, I've worked in relationships like that, and it can be frustrating because you know each other so well, but it's really rewarding. You really do feel like you are all working toward the same goals and you can expand your service offerings and ways that we've talked about in previous episodes through these clients, the relationships tend to last a long time.

There's not a lot of price sensitivity, like what the literature says is this is very trust-based relationship. As long as the price doesn't get to a point where they feel like you're taking advantage of them. As soon as that happens, it opens the door for them to start looking around, start talking to other providers. Usually, when they do that, it's just a way to make the price lower.

They do that because they feel like the price has gone up and maybe that you've taken advantage of the nature of the relationship, that's when they start to look around. Those things aside, these are the relationships that can go on for years. If you have one or two of these, they become the bedrock of financial stability that you can build the firm on. I would put the relationship buyer at the top.

David: This is almost a scenario where let's say there's an amorphous project coming up and you really don't know how to charge for it. You might even say to the client, "I'm not sure how to charge for this." You're going to be fair with me. You've been fair all along. What do you think this should be? I've said that a few times, that's where there's such a level of trust and you don't want to overcharge. You don't want to undercharge, just maintaining that value relationship is more important than the actual money sometimes.

Blair: Yes. Great insight.

David: The second one is value. That's next?

Blair: Yes. I put buyers next. What I love about value buyers is they're focused on outcomes, so they are price-sensitive, but the price it's both sides. It's relative to the ROI. They're willing to pay a lot more if the return is there and somebody who's an advocate of value-based pricing in a sea of per-price buyers, when you get a value buyer, it's a breath of fresh air.

David: Okay. I know it's last. The third must be convenience.

Blair: Yes. The third is a convenience buyer. Again, just this idea of a convenience buyer really makes the case for having a balanced lead generation plan. By that I mean, not all at the top of latter of lead generation, having some targeted outbound based on time-sensitive factors, that somebody who needs something now. It's ironic, you think of PR firms, they're the worst at new business, in my opinion, because when you ask them how they do it, they say, "Oh, word of mouth." What they mean is because they're in the PR business, they quite rightly feel like they need to demonstrate that, oh, no, we succeed based on our PR, and most of them aren't very good at that. When you think of somebody who should be doing targeted outreach, it would be a PR firm specializing in crisis communications.

David: Right. Then last is price buyers, which we don't rule these out entirely, there's a time and a place for them.

Blair: Yes and we've talked about a minimum level of engagement where a client comes to you and says I have $50,000 and we say, well, we typically work with organizations that spend like a million dollars a year in fees with us or more, don't read anything into those numbers. That's just an example. Somebody's got 50,000 and your minimum level of engagement is a million, you wouldn't do business with them normally, unless it's project work, you have excess capacity, you don't have to compete for it and you can do it profitably and you can do it profitably in certain situations where you have excess capacity.

I would like the listener to hold on to that idea of excess capacity, and sell that excess capacity to price buyers. In situations where you don't have a high cost sale, you don't have to compete for it, and you strip out all the other things that you might do. Now, you should always put forward a multi-option proposal, we've done an episode on that and your cheapest option would be at the client's price where you strip out everything you need to strip out to get the price to a profitable price for you.

Then you add those things, the things that you think the client should do into the other options at higher prices, and those higher prices serve as price anchors and communicates to the client that while you really are getting a deal, because we would typically charge this middle price for the higher price. Let's not turn our noses up at price buyers but let's not lie to ourselves about the fact that we're going to win this on price and then try to get the next project and the next project and turn them into a value buyer over time, it's just not going to happen. These relationships are transactional and we undertake them when we have excess capacity.

David: One of the things I like about this is how the proposal can do, the heavy lifting. You may not know exactly what a buyer wants and cares about and if you present a very long, overly invested proposal with just one option, they say yes or no to, if you get that wrong, then you're leaving a lot of opportunity on the table and one of the points you've made is that the proposal, if constructed properly, can do a lot of the heavy lifting for you, in part, because it accounts for the fact that buyers are different and the proposal can be self-tailored as I see the options in here.

Blair: Exactly.

David: We've looked at how to rank the four buyer types are top of the list of the relationship and then value and then convenience and then price. Now we talked about this fifth weird one, the poker players, how do they fit into the ranking of the four buyer types.

Blair: Remember, a poker player is one of the two most desirable clients, they are a relationship buyer or a value buyer, they're just presenting as a price buyer. Interestingly enough, how we negotiate with these two price buyers and the poker players, it's the same way you basically you use your proposal to do almost all of the heavy lifting in the negotiating, you put forward a three-option proposal like I've already said, were the cheapest option, you strip out all the extra value drivers like terms is a big one takeout terms, meaning they pay in advance takeout access to senior decision-maker, takeout all levels, reporting, et cetera.

Takeout all these things you usually do and say, "Here's what you get, and here's the price" and then in the middle option, you add back terms and access and things that-- If you're not sure if this is a price buyer or a poker player, add back in those things you think they want, or they said they want that you're not going to give them that price and then you always start with the high anchor, you given the three options, and the poker players will out themselves. They will out themselves by saying, "Okay, I want this price but I want some of these other things in these other options."

What you have to do when you're dealing with a price buyer or a poker player, where you don't know if they're a price buyer or not, is you have to hold the line, there's a term called a fence, you have to see this fence between the cheapest options and all the other options. You do not negotiate when somebody says, "I want these other things from these more expensive options, but at the cheapest price." The answer is effectively, "Well, if you want those things that that option, that's the price." The document has done that and all you have to do is hold the line and you will see a poker player will move. They will say, no, I want the middle one or the expensive one, but they'll just try to get a cheaper and the price buyer will go, "I don't care about that other stuff. I want the cheapest price. Let's do it."

David: Yes and then just move ahead quite arguing at that point.

Blair: Yes.

David: All right, four types, relationship, value, convenience, price, and then this odd amalgam of two of them, the poker player, which is kind of a combination of the relationship and the value buyer. This might be an episode that you got to go back and listen to with that chart from the notes in front of you that it makes more sense and then start by thinking back over how you've sold your current clients and just try to rate them and then moving forward, try to figure out as early as possible in the process, what kind of buyer it is, and then you can shape how you do it. This has been really interesting. Thank you, Blair.

Blair: Thanks, David.